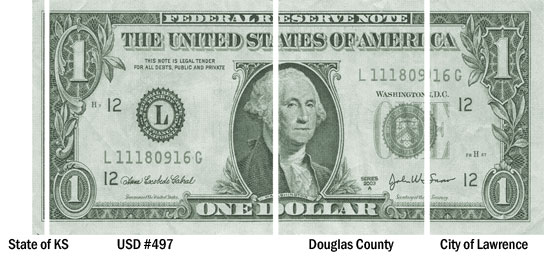

Property owners in the City of Lawrence pay property taxes each year. Property taxes include taxes for four government units: Douglas County, the State of Kansas, Unified School District #497, and the City of Lawrence. Each unit of government determines its own tax rate depending on needs.

Property tax rates are based on mills and are assessed through a mill levy. One mill is equivalent to one dollar for every thousand dollars of assessed property value.

| Mills* | |

|---|---|

| City of Lawrence | 33.278 |

| Douglas County | 46.015 |

| State of Kansas | 1.500 |

| USD #497 | 54.427 |

| Total | 135.22 |

* The mill levies provided by the 2018 Douglas County Tax Levy Sheet. Prior year mill levies can be found here: https://www.douglascountyks.org/depts/budget/services/mill-levies.

Property Tax Resources

The State of Kansas provides property tax relief programs for seniors. For more information regarding these programs, please visit https://www.ksrevenue.org/perstaxtypeshs.html.

Estimate Property Taxes

To calculate your estimated property tax bill, you need to know the approximate appraised value of your property. The total value of the house is then multiplied by 11.5% for residential property, or 25% for commercial/industrial property, to determine the assessed property value.

Therefore, a house appraised at $100,000 would have an assessed value of $11,500 ($100,000 X 11.5%).